Market view

Back to a slight underweight in equities

Prof. Dr. Jan Viebig, Global Co-CIO ODDO BHF AM.

The situation on the financial markets has changed more fundamentally in recent months than it has in a long time. Under the impression of strongly rising inflation rates, the central banks have tightened their monetary policy considerably over a very short period of about one year. This has been accompanied by strains on both the economy and the financial markets. This is precisely what the central bankers intend: you cannot make omelets without breaking eggs. Likewise, inflation cannot be fought without slowing down aggregate demand.

Fighting inflation through monetary policy carries risks. Banks live to a large extent from maturity transformation: they turn client’s short-term deposits into loans and securities investments with longer maturities. This results in interest rate risks for the banks. This is because the market value of bonds and loans falls when interest rates rise. The collapse of the Silicon Valley Bank is a warning: the bank had invested high inflows of its customers in long-term securities, the value of which fell when interest rates rose. The correction of the long-term securities in turn led to high unrealized losses, which have been the doom of Silicon Valley Bank. The unrealized losses of all US banks from securities holdings currently amount to around 620 billion dollars (source: FDIC, as of the end of 2022).

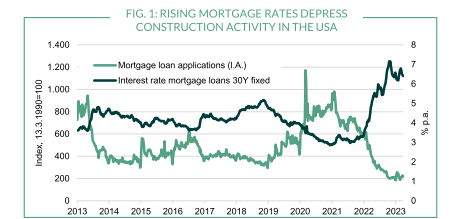

Typically, credit default risks also increase when financing costs rise. Or to paraphrase Warren Buffet: "Only when the tide goes out you learn who has been swimming naked." Vulnerable to the rise in interest rates are all economic sectors with high levels of debt. That is why the real estate sector has recently come into focus. In the years of low interest rates, prices rose rapidly, and construction activity boomed. This may have encouraged excesses that are now being caught up with reality. In any case, rising interest rates are likely to limit construction activity because projects become unprofitable or can no longer be easily financed (see graph).

The period of high price increases in the real estate market is thus likely to come to an end for the time being. The Case Shiller Index, which tracks the development of house prices for existing properties in the 20 most important cities in the USA, shows a price decline of almost 7 percent (until Jan. 2023) compared to the peak in June 2022. A similar trend can also be seen in Europe. Eurostat's house price index shows a price decline of 1.7 per cent for the euro area in the fourth quarter. For Germany, the figures even show a decline of 5.9 percent in the second half of the year.

As a result, investors are also paying more attention to debt instruments backed by real estate. The default rates of commercial mortgage-backed securities are still low, but the US press reported some cases in which the securities could no longer be serviced. In Europe, too, the state of the market is under attack: Recently, for example, it became known that the South Korean owners of the Trianon high-rise in Frankfurt - currently still the headquarters of Deka - are negotiating a restructuring of the debt.

The increase in tensions in the banking system and the real estate market are an indication that monetary tightening is beginning to take effect. Whether this will lead to a recession is an open question. For this reason, market participants are currently paying particular attention to the yield curves. Here the curves in the USA as well as in Europe are inverted: Yields for short residual maturities (up to two years) are currently higher than those for long ones (for example, ten years). According to Bloomberg, economic experts currently estimate the probability of a recession at an average of 65 percent for the USA and just under 50 percent for the euro area.

However, we see no reason for "doom & gloom". Labor markets on both sides of the Atlantic are robust. Unemployment is low and many sectors of the economy are desperate for workers.

Continued high employment levels, decent wage growth and possibly some relief from lower energy prices are helping to stabilize consumer confidence and provide support for consumer demand so far. In addition, there is a high probability that inflation rates will fall, and the cycle of interest rate hikes will end, first in the USA and later this year in Europe.

The picture for investors in the equity market is thus mixed. Earnings expectations for companies are weakening, downward revisions of earnings estimate for the beginning reporting season dominate the picture. In addition, equity markets had rallied strongly over the past six months, and valuation levels have risen in many cases. The U.S. markets are not favorably valued, and we believe that the European markets have also lost their significant valuation advantage. Finally, the equity markets have also become less attractive relative to the bond market: safe short-term German government bonds offer a yield of about 2.5 per cent, solid corporate bonds on average about 4.0 per cent (BofA ML Euro Corporate Index). The share is thus no longer without alternative. Overall, the greater uncertainty has prompted us to become somewhat more cautious in managing the funds entrusted to us. With this in mind, we have changed the positioning on the stock market from "neutral" to "slightly underweight", which corresponds to a moderate reduction in the equity quota.

Press Contact :

Olivier Duquaine

Gunther De Backer

About ODDO BHF Asset Management

With €54 bn assets under management as of December 31, 2022, and 4 investment centres based in Paris, Düsseldorf, Frankfurt, and Luxembourg, ODDO BHF AM is a leading asset manager in Europe and part of the Franco-German financial group ODDO BHF that was founded in 1849. It comprises ODDO BHF AM GmbH in Germany, ODDO BHF AM SAS and METROPOLE Gestion in France, and ODDO BHF AM Lux in Luxembourg. ODDO BHF AM offers investment solutions in equities, fixed income, asset allocation, private equity and private debt to institutional clients and distribution partners. ESG integration, exclusions and active ownership are the 3 pillars of our sustainability strategy recognized for its quality and reliability through the labelling of our funds by independent bodies, and the awards obtained. ODDO BHF AM relies on a strong local presence in major European cities and in-depth knowledge of the markets in which the management company invests. ODDO BHF AM’s investment style is characterized by an active and long-term investment approach with the aim to create long-term and sustainable value for its customers. To do so, ODDO BHF AM has been integrating ESG (environmental, social and governance) criteria into its investment processes for more than ten years. Accordingly, clients have access to a wide range of sustainable financial solutions across all asset classes.

www.am.oddo-bhf.com https://pa.oddo-bhf.com/en