Macroeconomic view

Growth depends on credit… and vice versa

Bruno Cavalier, Chief Economist ODDO BHF AM.

Key highlights:

- After the recent bout of stress, banks will be tightening their lending standards.

- This is likely to weigh on business conditions and on inflation.

- A dilemma for central banks: should they trade off price stability against financial stability?

- The tightening cycle in policy rates is coming to an end.

The mutual dependence between the real economy and the banking sector goes without saying. This is obvious when everything is going well – a robust economy reduces the risk of default and encourages banks to lend to businesses and households. This, in turn, supports spending and stimulates economic growth. But, beyond a certain point, credit can expand too fast and fund unprofitable investments, requiring banks to purge their balance sheets. This is a brief history of banking crises. In recent weeks, failures of several US regional banks and Credit Suisse in Europe have revived stress in the banking sector. This has created a risk to the financing of the economy and to the growth outlook.

How did we get to this point? The root of the current problems lies in the shift in monetary policy almost everywhere in the world in early 2022. For more than a year, central banks have responded to the inflation shock by raising their policy rates at an unprecedented pace. They have done so to cool down an overheated economy. One of the ways to do this is precisely to make credit conditions more restrictive. The difficulty lies in the dosage of the restriction and its transmission to the economy. Commercial banks’ activity basically

consists of transforming cheap short-term resources (deposits) into more highly remunerated longer-term uses, such as loans and securities purchases. That’s why rising interest rates are normally good news for banks, as that widens their net interest margin. However, rising rates can also have unfavorable consequences, as it exacerbates borrowers’ probability of default and reduces the value of portfolios. It may encourage depositors to seek a better return on their cash outside the banking system.

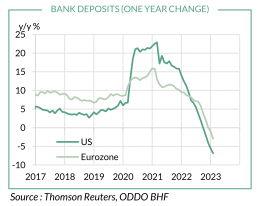

California's Silicon Valley Bank (SVB) piled on all these risks at once and each to an extreme degree. It failed in just a few hours when it became clear that it had not hedged any of its interest-rate risk and that its depositors were pulling out their savings massively. Bank supervisors appear to have been particularly lax. While an extreme example, SVB highlights banks’ vulnerabilities amidst the new interest-rate regime. Bank deposits had surged during the pandemic, when spending was constrained, but have now been shrinking for several months (see chart). Overall, this is a normal mean-reversion process, but in addition, it signals some fears for the health of the most vulnerable banks.

What are the repercussions of these developments on economic activity and monetary policy choices? One inevitable consequence is that commercial banks will be more conservative. Higher interest rates, increased geopolitical uncertainty caused by the war in Ukraine, and global economic slowdown – all are contributing to tougher lending standards andweighing on demand for credit from households and businesses. As a matter of fact, credit conditions have been tightening for one year now. This trend will intensify.

Real estate is the most vulnerable sector. In residential real estate, exposure varies depending on the structure of financing and price levels. After surging over the pandemic period, housing prices have begun to recede since mid-2022 in the US and a little more recently in the euro zone. Some Nordic countries that combine a high proportion of floating-rate loans and heavy household debt are more vulnerable than continental Europe. In commercial real estate, higher interest rates have made projects more expensive just as their yields are falling, for example, in offices due to higher vacancy rates. In the US, almost three quarters of commercial real estate loans are granted by regional banks, although they take in just one third of deposits. The risk of reduced lending is therefore especially high.

The recent surge in stress has placed central banks before a dilemma. On the one hand, they play a role in stabilising the economy, particularly prices. They therefore are naturally inclined to raise their policy rates when inflation is too high, but in doing so, they undermine banks’ operating conditions. Another of their missions is to ensure the stability of the financial system.

Must one goal be sacrificed to the other? Both the Fed’s Jerome Powell and the ECB’s Christine Lagarde have been at pains to deny any such dilemma, arguing that central banks have enough instruments to meet both objectives. They can provide almost unlimited liquidity in response to a shortage. Indeed, in reaction to the SVB failure, the Fed created a new programme for this very purpose (BTFP). In theory, this does not keep them from raising their rates, but in practice, these various instruments are not completely watertight. If a general banking crisis were to occur, monetary policy would have to be eased. Fortunately, we’re not there, but at the very least, the tightening cycle appears to be approaching its end in the US and Europe.

Press Contact :

Olivier Duquaine

Gunther De Backer

About ODDO BHF Asset Management

With €54 bn assets under management as of December 31, 2022, and 4 investment centres based in Paris, Düsseldorf, Frankfurt, and Luxembourg, ODDO BHF AM is a leading asset manager in Europe and part of the Franco-German financial group ODDO BHF that was founded in 1849. It comprises ODDO BHF AM GmbH in Germany, ODDO BHF AM SAS and METROPOLE Gestion in France, and ODDO BHF AM Lux in Luxembourg. ODDO BHF AM offers investment solutions in equities, fixed income, asset allocation, private equity and private debt to institutional clients and distribution partners. ESG integration, exclusions and active ownership are the 3 pillars of our sustainability strategy recognized for its quality and reliability through the labelling of our funds by independent bodies, and the awards obtained. ODDO BHF AM relies on a strong local presence in major European cities and in-depth knowledge of the markets in which the management company invests. ODDO BHF AM’s investment style is characterized by an active and long-term investment approach with the aim to create long-term and sustainable value for its customers. To do so, ODDO BHF AM has been integrating ESG (environmental, social and governance) criteria into its investment processes for more than ten years. Accordingly, clients have access to a wide range of sustainable financial solutions across all asset classes.

www.am.oddo-bhf.com https://pa.oddo-bhf.com/en