Flash info - ODDO BHF Artificial Intelligence

STORY OF THE MONTH

In this latest edition of the ODDO BHF Artificial Intelligence monthly flash info, we present our exposure to the cyber-security sector, which we hold via leading North American cybersecurity companies. We do so as growth on this market is accelerating on all continents.

Cyberattacks: we are witnessing an acceleration in history

Target in 2013 (when dozens of millions of bank cards were hacked), Equifax in 2017 (three months that ruined the reputation of the US credit bureau), SolarWinds in 2020 (18,000 organisations were reported hit, including Microsoft and Cisco) and so on and so forth – the history of the 21st century had already been marked by a number of attention-grabbing cyberattacks. And yet, in this first quarter of 2022, we seem to have moved up a notch. In almost the same week, we learned that: 1) Toyota, the giant automaker, had decided to shut down its Japanese production facilities (with a total daily capacity of 13000 vehicles) when one of its subcontractors reported that it had fallen victim to a cyberattack; 2) the US semiconductor leader, Nvidia, revealed that a virus attack of unknown origin had paralysed its decision-making centre (without any apparent impact on production); and 3) from the moment the Russo-Ukrainian war broke out, Ukrainian government information systems were paralysed by cyberattacks, of which there is little doubt about the origin.

A constantly growing market

Growth by US cybersecurity companies (whose reach is actually global) is not only not slowing but, in fact, has crossed upward through several thresholds in a row. Year-on-year growth in billings by the main US cybersecurity providers has risen from a range of 15/20% in 2019 to 20/25% in 2020 and to 25%/32% in 2021, according to Morgan Stanley. Global companies are keenly aware of the importance of cybersecurity, and there is a boom in cybersecurity needs as they move parts of their IT systems into the public cloud, especially with the increased use of remote-working. We expect the next leg of growth to come from the US federal government (estimated at about USD 20bn by Morgan Stanley) and, more generally, from governments amidst the uncertain geopolitical environment we are now facing.

The fund’s exposure to cybersecurity

Our portfolio of about 40 stocks currently includes two cybersecurity stocks: 1) Fortinet (which we have held for several years now) is a firewall leader that also managed to position itself first in SD-WAN protection (a form of private network used heavily by companies having several websites); this has earned it a long series of high-growth quarters; Fortinet is gaining market share structurally due to pricing that is attractive (in comparison to its direct competitors), given the quality of its solutions; 2) Zscaler, which we acquired more recently, is a flagship zero-trust company; zero-trust is an approach to security that addresses companies’ underlying issues in moving parts of their IT systems onto the public cloud. Zscaler is one of the few “rule of 70” US companies (i.e., the sum of its organic sales growth and its operating margin amount to at least 70). At its latest quarterly presentation, the group showed the market that its next stage of growth will be US federal government agencies, a market that it has thus far hardly penetrated.

By the way, why bring cybersecurity into an artificial intelligence fund?

Cybersecurity in all its forms (endpoint, firewall, SASE, identity management, zero-trust; etc.) is making growing use of artificial intelligence and machine learning to detect attempted intrusions, which continue to grow in number and sophistication. The ultimate stage is likely to be quantum computers or neuromorphic computation, which could probably “crack” the most solid information systems. The only defence then will be AI-based cybersecurity tools. Cybersecurity publishers such as Sentinel One (US) and DarkTrace (UK) have placed artificial intelligence at the heart of their detection systems.

None of the aforementioned companies constitutes an investment recommendation.

Past performances are not a reliable indicator of future performances and are not constant over time.

ODDO BHF ARTIFICIAL INTELLIGENCE

• A new way of managing investments: The power of artificial intelligence (AI) combined with a proven quantitative model that captures the performance of the best global listed Artificial Intelligence companies.

• A robust theme: With its structural growth engines, we expect AI to grow faster than other economic sectors. Companies able to seize the opportunity are likely to create value in the long run.

• Integration of artificial intelligence in the investment process: This unique approach allows us to analyse more than 4 m pieces of data each day and to quickly detect new trends in the theme and shifts in market sentiment, while capturing the growth of under-the-radar small and mid caps on a global scale.

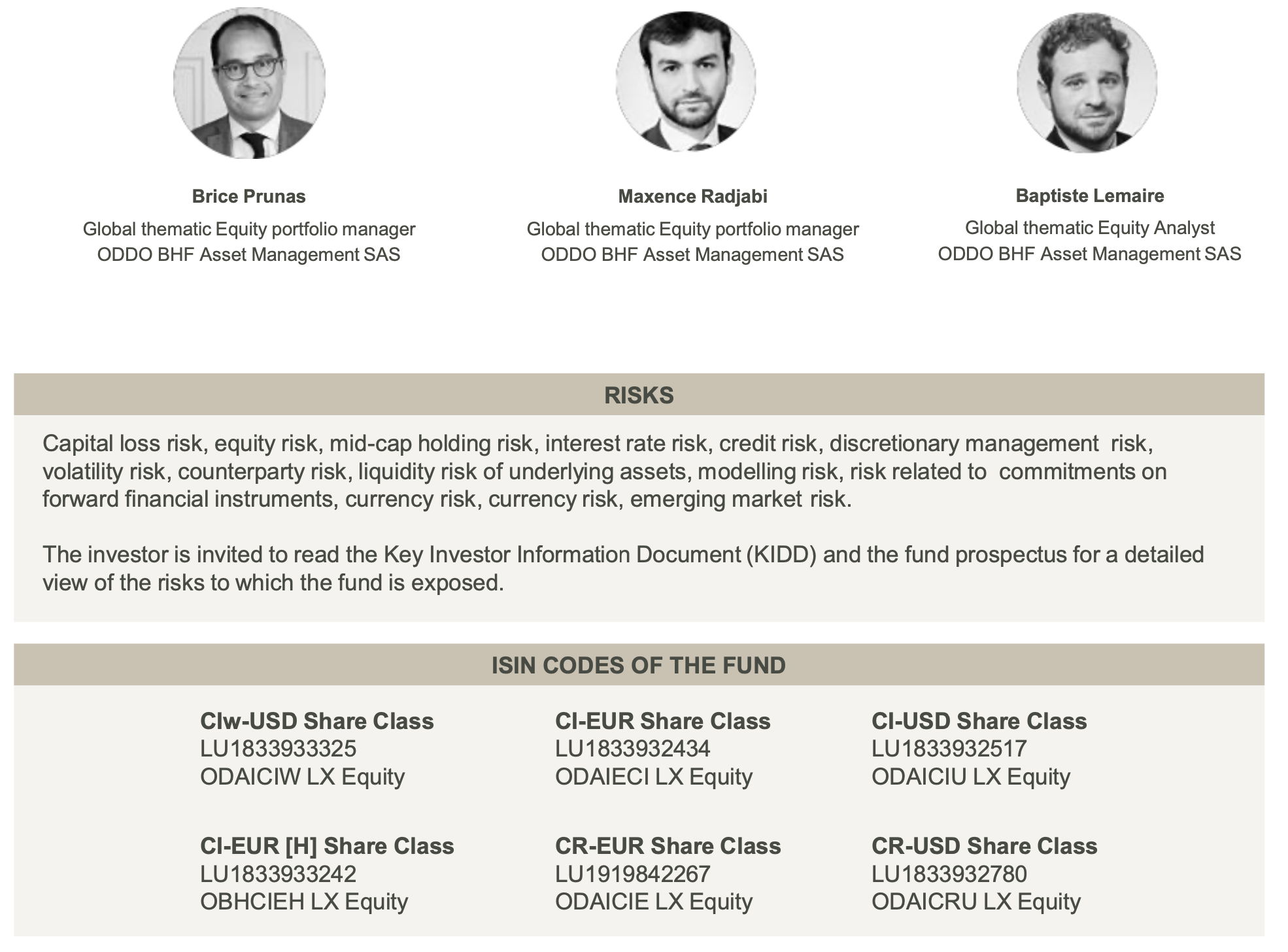

• An experienced team whose talents play off one another: Brice Prunas, a manager with more than 20 years of experience as a financial analyst specialising in technologies. Maxence Radjabi, a manager with three years of experience in investing with a bent towards quantitative analysis.

Disclaimer

ODDO BHF AM is the asset management division of the ODDO BHF Group. It is the common brand of four legally separate asset management companies: ODDO BHF AM SAS (France), ODDO BHF PRIVATE EQUITY (France), ODDO BHF AM GmbH (Germany) and ODDO BHF AM Lux (Luxembourg).This document has been drawn up by ODDO BHF ASSET MANAGEMENT SAS. for market communication. Its communication to any investor is the exclusive responsibility of each distributor or advisor. Potential investors should consult an investment advisor before subscribing to the fund. The investor is informed that the fund presents a risk of capital loss, but also many risks linked to the financial instruments/strategies in the portfolio. In case of subscription, investors must consult the Key Investor Information Document (KIID) and the fund’s prospectus in order to acquaint themselves with the detailed nature of any risks incurred. The value of the investment may vary both upwards and downwards and may not be returned in full. The investment must be made in accordance with investors’ investment objectives, their investment horizon and their capacity to deal with the risk arising from the transaction. ODDO BHF ASSET MANAGEMENT SAS cannot be held responsible for any direct or indirect damages resulting from the use of this document or the information contained in it. This information is provided for indicative purposes and may be modified at any moment without prior notice. Any opinions presented in this document result from our market forecasts on the publication date. They are subject to change according to market conditions and ODDO BHF ASSET MANAGEMENT SAS shall not in any case be held contractually liable for them. The net asset values presented in this document are provided for indicative purposes only. Only the net asset value marked on the transaction statement and the securities account statement is authoritative. Subscriptions and redemptions of mutual funds are processed at an unknown asset value. The Key Investor Information Document (French, English, Italian, German, Spanish) and the prospectus (French, English) are available free of charge from ODDO BHF ASSET MANAGEMENT SAS or at am.oddo-bhf.com or at authorized distributors. The annual and interim reports are available free of charge from ODDO BHF ASSET MANAGEMENT SAS or on its internet site am.oddo-bhf.com

The fund is licensed for sale in Switzerland. The Key Investor Information Document, the prospectus, the annual and interim reports for Switzerland can be obtained free of charge from the Swiss Representative and paying agent, BNP Paribas Securities Services, succursale de Zurich, Selnaustrasse 16, 8002 Zurich, Switzerland.