Flash Info ODDO BHF Active Small Cap

By the management team of the ODDO BHF Active Small Cap range of ODDO BHF Asset Management.

STORY OF THE MONTH

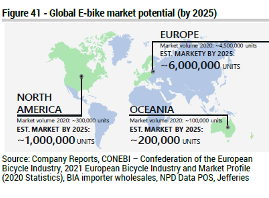

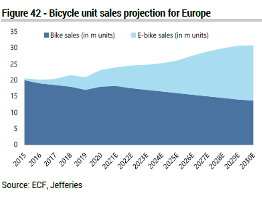

The European e-bike market is expected to grow at a CAGR of 19% between 2020 and 2025, reaching 11 million units sold by 2025. E-bikes are expected to account for more than half of total estimated bicycle sales in 2030, or 18 million units.

Demand for electric bicycles has risen sharply with the COVID-19 pandemic. As consumer mobility preferences have shifted towards personal over public transport, e-bikes have emerged as a viable option for urban dwellers, boosting demand over the year.

E-bikes as a new means of transport

Bikes are increasingly seen as a cheap and healthy alternative to cars and public transport. Traffic congestion, growing interest in environmental issues, rising fuel prices and the high cost of parking have stimulated the use of bicycles as a means of daily transport. According to a study by SD Worx, the average commute to work is 29 km in the EU, and almost 80% of workers surveyed travel less than 40 km per day to work. The average distance travelled by bicycle is 10 km, while with electric bikes it can reach 20-25 km. Therefore, we argue that in a large number of cases, the electric bicycle could be used to commute to work, thus providing an alternative means of travel. Furthermore, other surveys have shown that 62% of people are willing to give up their current means of transport if they could use an electric bike to get to work.

E-bikes as a way of life

Cycling is healthy, environmentally friendly and socially responsible, all of which are important factors when consumers think about meeting their mobility, sports and leisure needs; cycling becomes a lifestyle. Moreover, when exercising or commuting by bike, the carbon footprint, apart from the manufacture of the bike and its transport to the consumer, is zero.

More importantly, the momentum for sustained growth appears to be sustainable thanks to an increasing supply of electric bikes, such as cargo bikes (ideal for last mile deliveries), electric mountain bikes, electric racing bikes etc., thus meeting the leisure and service demands of a much wider target population. As a result, the perception of the electric bicycle has evolved from a product for "expert users" to one that is gradually becoming trendy and indispensable to all.

Regulations favourable to the adoption of electric bikes

Regulations and infrastructures are designed to respond more effectively to the problems of congestion in cities and discourage the use of cars in metropolitan areas and favour the use of bicycles, as can be seen in London, Paris, Hamburg, Copenhagen, and many other cities in Europe. Bicycle lanes on boulevards, special bicycle paths through forest areas and increased bicycle parking (even in underground facilities) near public transport hubs are all part of this.

Governments, provinces, cities and the European Commission (Directive on road infrastructure safety management) encourage the use of bicycles for commuting and other purposes. The French and Italian governments have implemented specific measures related to COVID-19, amounting to 20 and 120 million euros respectively, to stimulate the use of bicycles (mainly subsidies for electric bikes), while the list of cities that are expanding the number of cycling facilities is growing.

With all this in mind, we have selected several companies from our broad European small cap universe that, thanks to their niche positioning and competitive advantages, should benefit fully from this fast-growing market.

Past performance is not a reliable indication of future return and is not constant over time.

ODDO BHF ACTIVE SMALL CAP

• A long-term expertise: ODDO BHF has developed a specific know-how on the analysis of European Small caps. The management team is led by Guillaume Chieusse, who has more than 20 years of experience.

• A proven investment process: The management team identifies growth stocks within promising themes and sectors based on the GARP (Growth at Reasonable Price) approach.

• A pure bottom-up approach based on stock-picking: Investment decisions are based on rigorous fundamental analysis using proprietary tools and models. This approach makes it possible to select companies that demonstrate a greater focus on innovation.

• A portfolio built to try to capture market momentum: The team considers the momentum in its investments decisions and takes into account the potential upward revision of revenue and earnings growth, a change in analyst recommendation, etc.

Press contacts:

Gunther De Backer

Olivier Duquaine

Disclaimer

ODDO BHF AM is the asset management division of the ODDO BHF Group. It is the common brand of four legally separate asset management companies: ODDO BHF AM SAS (France), ODDO BHF PRIVATE EQUITY (France), ODDO BHF AM GmbH (Germany) and ODDO BHF AM Lux (Luxembourg).

This document has been drawn up by ODDO BHF ASSET MANAGEMENT SAS. for market communication. Its communication to any investor is the exclusive responsibility of each distributor or advisor.

Potential investors should consult an investment advisor before subscribing to the fund. The investor is informed that the fund presents a risk of capital loss, but also many risks linked to the financial instruments/strategies in the portfolio. In case of subscription, investors must consult the Key Investor Information Document (KIID) and the fund’s prospectus in order to acquaint themselves with the detailed nature of any risks incurred. The value of the investment may vary both upwards and downwards and may not be returned in full. The investment must be made in accordance with investors’ investment objectives, their investment horizon and their capacity to deal with the risk arising from the transaction. ODDO BHF ASSET MANAGEMENT SAS cannot be held responsible for any direct or indirect damages resulting from the use of this document or the information contained in it. This information is provided for indicative purposes and may be modified at any moment without prior notice.

Any opinions presented in this document result from our market forecasts on the publication date. They are subject to change according to market conditions and ODDO BHF ASSET MANAGEMENT SAS shall not in any case be held contractually liable for them. The net asset values presented in this document are provided for indicative purposes only. Only the net asset value marked on the transaction statement and the securities account statement is authoritative. Subscriptions and redemptions of mutual funds are processed at an unknown asset value.

The Key Investor Information Document (DEU, ENG, FR, ESP, ITL, SWD, NLD, DAN) and the prospectus (ENG, FR) are available free of charge from ODDO BHF ASSET MANAGEMENT SAS or at am.oddo-bhf.com or at authorized distributors. The annual and interim reports are available free of charge from ODDO BHF ASSET MANAGEMENT SAS or on its internet site am.oddo-bhf.com

The fund is licensed for sale in Switzerland. The Key Investor Information Document, the prospectus, the annual and interim reports for Switzerland can be obtained free of charge from the Swiss Representative and paying agent, RBC INVESTOR SERVICES BANK, succursale de Zürich, Bleicherweg 7, 8027 Zürich, Switzerland.